We continually hear about the "affordability crisis" and how the three major levels

of government need to better support affordability for everyday Canadians

across costs in;

• housing

• food

• energy

• dental

• transportation

• child care

• health care

• education

• municipal taxes

The Bank of Canada and Statistics Canada assure us inflation, by measures of CPI, are well

within target range; but, somehow that doesn't feel right. Even for high earners

(but not the 1%), there is less to go around. In the past year, CPI is being quoted at 2.1%,

while the 5-year compound annual growth rate (cagr) is 3.8%. There are various wage increases

quoted from a low of 2.5% to a high of 3.5% over periods of 20 to 4 years, respectively.

Yes, it does get confusing.

Municipal Taxes

The yearly ritual presented in Canadian cities is the budget review for the coming year.

The process can be muddled; the actual budget is not discussed, rather, the discussion centres

on increases to the previous year's budget, i.e., amendments. Yes, that's right! Rather than

ensuring that all the prior year's budget was spent effectively, the assumption is

that it was, and, anyways it's spent and the coming year requires greater expenditure to cover all the

usual factors. Prominent among these is municipal population growth, staff increases,

maintaining service levels, contractor cost and other demand side increases.

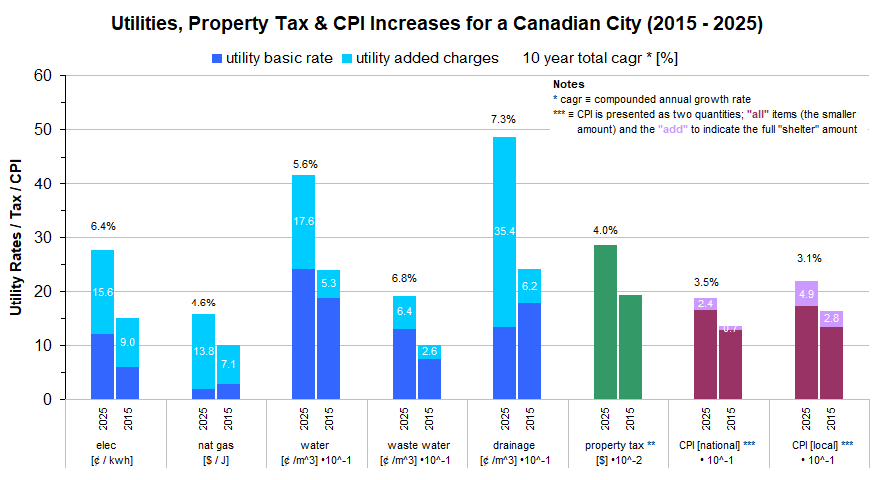

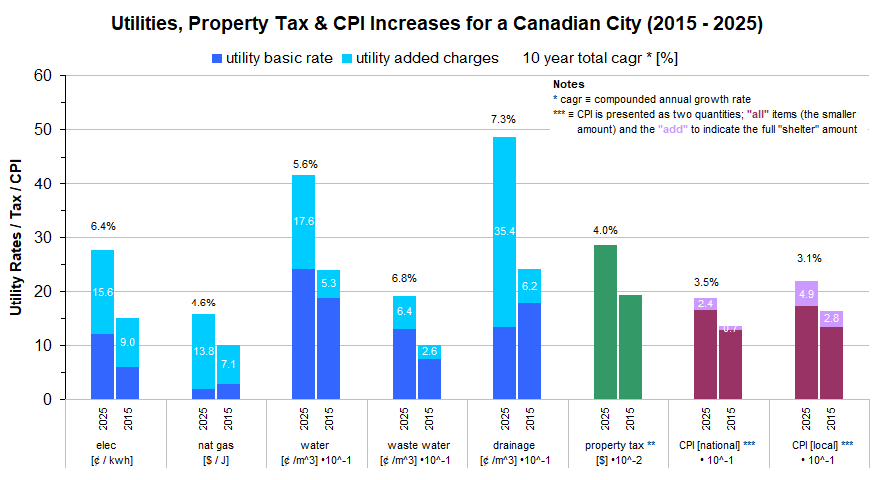

For the particular example below, the 5-year property tax cagr increase is 4.0%. That's a first

indication that costs are definitey growing faster than headline CPI. In addition, many cities

in Canada own all, or portion of, their local utilities; for one city, its utility rates

have outpaced CPI by significant measure leading to a doubling in under 10 years i.e.,

> 7% per year!

Property Tax / Utility / CPI Increases

The figure below covers a 10 year period for a specific municipality; notice how the

utility charges rely on ever increasing fees to the base utility rate with, generally,

both fees and basic rates doubling at 10 year interval pace and which is over

twice the rate of CPI increases. Those fees include charges by the municipality.

The property tax increase appears to be less onerous but hides the fact that some costs

have been downloaded onto additional utility billing as added "fees".

It's ironic that municipalities are seeking to identify ever more revenue streams in order

to appear to be holding the line on property tax increases.

An Affordability Solution

The politicians' and bureaucrats' (federal, provincial, municipal) solution to the

affordability "crisis" seems to be, for municipalities, to find additional revenue streams;

while provincial & federal governments thoughtlessly, increase budget deficits and debt.

This passes as increasing supports for affordability.

At one time, a factory labourer was able to raise a family with three kids,

had affordable gas for their vehicle, health care, property taxes, a modest house,

and mortgage of 6.35% (yes, those were affordable).

The kids worked part-time jobs in highschool and could afford to put themselves through

university by working summer jobs.

How did things change in the intervening years to where government debt is beyond sustainable

and municipalities reach ever deeper into the pockets of their residential & non-residential

property owners? Sometimes the starting point is to look back to when things were affordable,

i.e., benchmark to that more affordable time.

Contact the author if you wish to receive the Excel (TM) app to

calculate your specific situation or have questions; check the contact page.

John Aumuller, P. Eng., Ph. D.

|